Manage trading risk efficiently.

Set and manage multiple Stop Loss and Take Profit orders with ease.

Explore the feature step by step!

Set position size and adjust leverage.

Position size can be set in quote or base currency, or you can set the margin size in USDT or as a % of available balance. Pick one, see values in all. Leverage and Position size sliders are color-coded from optimal to risky.

Place targets and protect the downside.

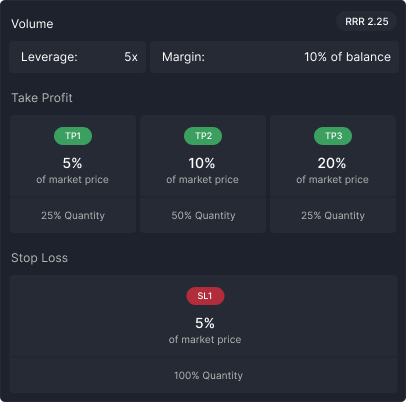

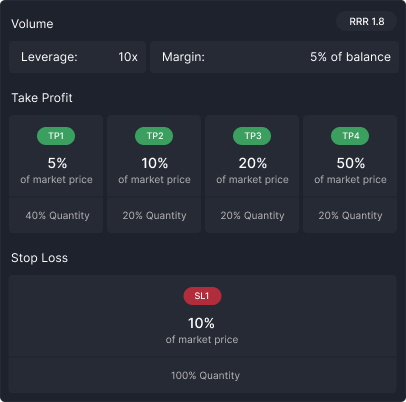

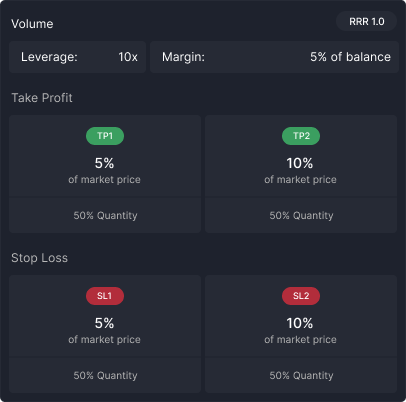

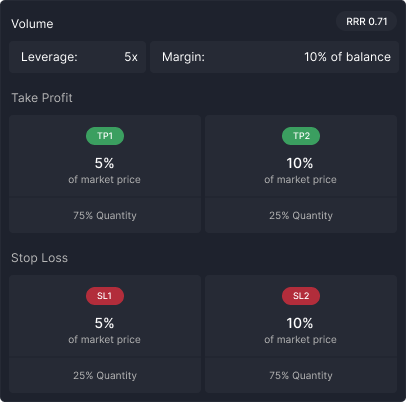

For optimal scaling out of your position you can place up to 4 Stop Loss and 4 Take Profit orders. Set them as a market price, distance from open price or as Profit/Loss you want to achieve with this protection.

Understand the risk before you act.

Now you can see the Risk to Reward Ratio of your position. You have all ingredients to adjust the position size, targets or stop losses. Check if the profit is worth the risk and if you are comfortable with the position size.

Review position in chart and trade.

All target and protection levels are automatically synced into the integrated trading chart. You can easily see how your trade fits into the current market structure and add any indicator the charting platform supports. All levels can be adjusted directly in the chart.

What makes Asset Management different than other tools out there?

Dynamic scaling of positions for different market conditions with 4 types of quantity, professional risk management options, and management of the whole position on an integrated trading chart.

Why is having multiple Stop Losses or Take Profits such an advantage?

It gives you the ability to scale out of the position efficiently without you watching the charts. Taking partial profits or limiting exposure is a great way to survive in the trading game.

How will my trading improve with Asset Management?

Understanding expected risk to reward ratio before you enter the trade is crucial. The ability to set multiple targets will help you lock in profits and detailed Stop Loss settings protect your downside.

Can Cleo manage my positions opened on exchange or elsewhere?

No, Only positions created in cleo.finance can be managed.